To order a property is amongst the prominent orders people will make in their lives, and you may taking out fully a home loan is a type of cure for fund the acquisition. That it primer towards home loans shows you the loan principles loans Silver Cliff CO, in addition to what home financing is actually, normal form of finance together with notion of in search of a beneficial lender.

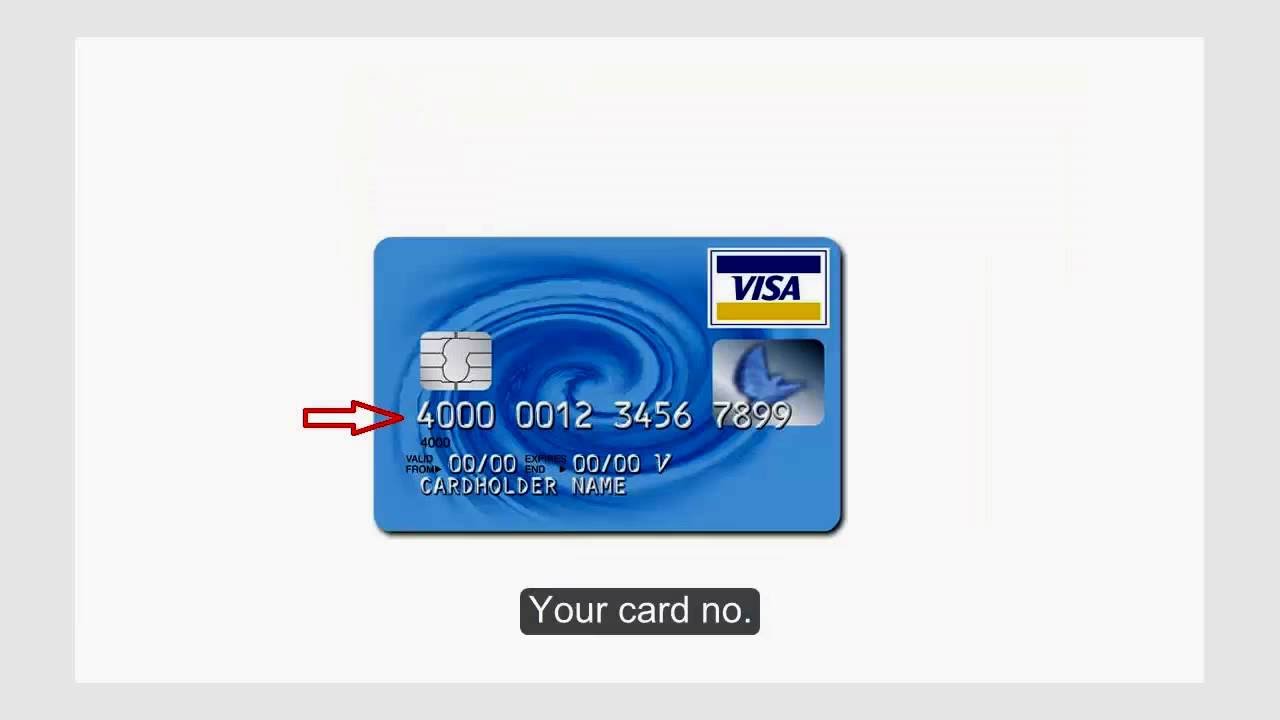

What is home financing?

A mortgage is actually a loan regularly purchase property otherwise different kind of a house. It uses your home once the guarantee, meaning that the lender contains the directly to make the term into the possessions if you fail to pay-off as a result of financial payments the bucks you have lent.

The definition of home loan ount of cash your obtain, which have notice, order your family. The borrowed funds count is often the purchase price of the home without their down payment.

Your month-to-month mortgage payment will generally incorporate principal, focus, escrow, fees, home insurance, individual mortgage insurance, and homeowner’s organization otherwise condo charge. The home loan servicer commonly blend this type of costs towards just one, payment.

Going for a loan Title

When deciding on the best financial to you, it is critical to check out the financing term, which is the amount of time it will take that pay off your loan before you could totally own your property. Your loan label have a tendency to affect the interest, monthly payment additionally the overall amount of focus you will shell out along side life of the mortgage.

- Less monthly payments than simply small-name mortgage loans, and come up with the home loan inexpensive times of the few days.

- Large financial rates, meaning possible pay alot more inside the interest over the longevity of the new loan.

- Lower interest levels than much time-name mortgage loans, definition you are able to spend quicker desire along side lifetime of the borrowed funds.

- Large monthly installments than enough time-title mortgages.

Thinking about that loan Form of

There’s two first type of mortgage loans: fixed-price mortgage loans and varying-rates mortgage loans. The loan form of will determine if for example the interest rate and you will monthly fee will vary over the years.

This means your own monthly mortgage repayment will continue to be an equivalent to possess the whole loan name. Of the percentage balances, fixed-rates mortgage loans may be the very used financing sorts of.

Adjustable-price mortgages (ARM) want rate that will change over the life span out-of the loan, and rates having Palms typically start-off less than the ones from a fixed-speed home loan. After an initial keep several months, ranging from half a year to help you a decade, their interest rate will be different based on market requirements, if higher or less than your current price. Yet not, Palms has maximums and you will minimums that the rate of interest can change at each variations several months, as well as the life span of your loan.

Interested in a lender

Once you decide which mortgage device best suits your financial situation and requires, it is the right time to go shopping for a lender. Your financial is an essential part of your homebuying team, and they’ll assist show you through the remaining financial procedure.

Before you could come across a lender, you will need to speak about the options. Different lenders can give different terminology and you may rates and you will charges other charges to possess a home loan. Examining home loan choice having multiple lenders could potentially save you plenty over the life of the loan.

You could potentially obtain quotes away from a number of lenders, plus mortgage officers on financial institutions and you can credit unions, along with home loans and you can low-financial lenders. Correspond with multiple loan providers to find the best solution to complement your position.

A mortgage is a long-name commitment. In addition to a lender, envision talking-to good HUD-specialized construction counselor to talk about a knowledgeable mortgage options to arrive at their long-label homeownership goals.