Demand for custom built property is on the rise and some Pros that happen to be in the industry to construct another type of house have discovered aside in regards to the Virtual assistant protected Construction financing program one to ‘s been around consistently. While you are a qualified Experienced and qualify for good $0 Down Va Mortgage, then you qualify for an effective $0 Off Virtual assistant framework loan as well! Not only can this type of Experienced consumers select and buy their desired lot / homes, even so they also can features a declare on design arrangements having a house creator of the choice for stick established, standard or are manufactured property. And they will manage to fund both parcel and the complete framework part of the mortgage which have $0 down, Virtual assistant One to-Day Intimate Build Loan. Why don’t we have a look at why using the Virtual assistant Construction loan try growing.

The brand new Va lender’s underwriter often still need to accept this new debtor for an effective Virtual assistant framework loan that they’ll manage to afford nonetheless meet the requirements financially

Effective , the latest Service from Veteran’s Activities eliminated the latest cap towards the restrict lending constraints. This is why fully qualified Veterans commonly limited if this concerns restriction financing constraints available in the fresh new condition of the proposed property. Having lenders giving Jumbo funds, loan number higher than the utmost limits, they want lowest off repayments ranging from 5% towards the up based on their company assistance. While the Va rules are obvious, lenders can be impose most direction that the industry is known due to the fact Overlays and every bank whom has the benefit of which Va Structure Financing program keeps enforced an optimum loan amount to have $0 off Va build loan you to range around $step one,five-hundred,000.

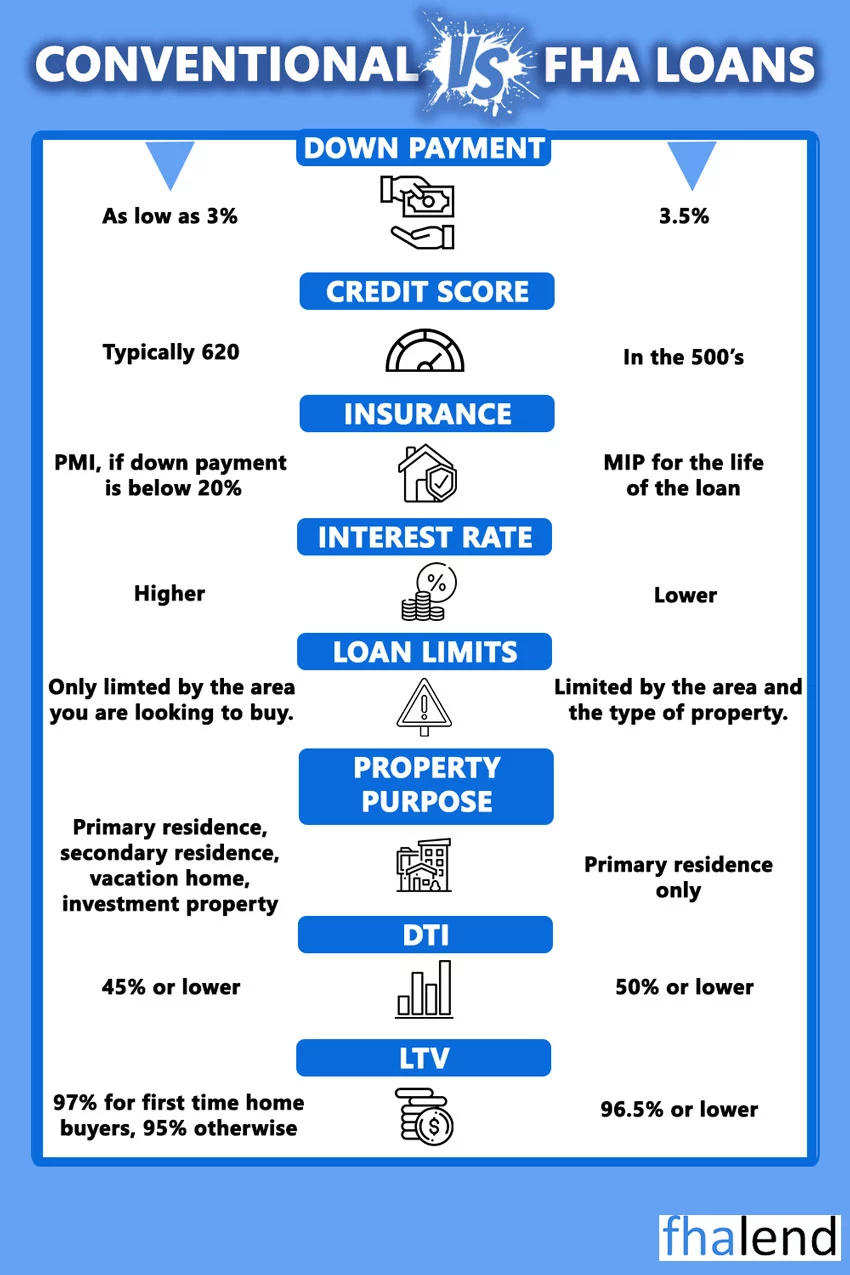

The best financial obligation-to-earnings ratio (DTI) appropriate to qualify for good Va financial was 41%. Simply put, your debt ratio measures up the complete month-to-month financial obligation repayments and you can divides they by the full pre- income tax monthly income. This new commission one performance ‘s the financial obligation-in order to income ratio. When your DTI proportion exceeds 41%, the newest Va lets the new underwriter to use a residual income guide calculation used together with other compensating factors to possess acceptance. Residual income is the number of net income remaining (immediately following deduction away from debts and you can financial obligation and you will month-to-month casing costs) to fund family relations living expenses including dining, medical care, clothes, and you may gas. Solid credit rating, large earnings account, and you can long-title a career are a few of multiple compensating facts useful loan acceptance.

This new Va Design Loan was designed for ease of use and you can not to ever end up being constraining toward Veteran. The rules doesn’t let the Seasoned to pay one attention can cost you in build phase of your mortgage. It focus try factored with the creator bargain and you can covered by the creator. One to translates into the newest Veteran spending no desire in the structure several months using their first contractual percentage undertaking the very first of the few days pursuing the the full calendar month shortly after its framework is finished. This will be a bona-fide virtue due to the fact Experienced doesn’t have to be concerned about to make repayments to their current mortgage or book along with pay for the eye financing inside design phase of one’s financing.

This is not your situation to your FHA, Federal national mortgage association, or Freddie Mac traditional loans where design mortgage applications is actually emergency no credit check loans capped because of the county restrictions for each program

Through to initial recognition of design loan partnership, the fresh new Seasoned get accepted shortly after having its credit featured and fulfilling minimal credit scores required by the newest Va Acknowledged originating bank. In addition, confirmation of cash & a job, financial comments or any other qualifying things was basically validated too. The newest underwriter approves brand new Veteran borrower only after all papers and recommendations has been verified. The loan is actually subsequently finalized, while the build pulls start. If home is completely completed because of the builder, the fresh Va lender doesn’t need any requalifying circumstances on Seasoned. New debtor only cues most documents and / or loan modification preparations no 2nd closure required. That is tall as it setting new Veteran doesn’t have to pay for people charges that would be billed on a great second closure.