- Mother or father Together with finance is college loans parents can take off to buy their children’s educations.

- However, those money feel the large interest rate – 6.28% – allowing personal debt to create faster for parents.

- Moms and dads told Insider they will nevertheless manage whatever needs doing to render the kids an education.

However it is uncertain if Also loans are part of the latest federal student-mortgage forgiveness conversation, even though both Pemberton and you will Clark advised Insider they aren’t carrying aside hope for people financing forgiveness, they don’t regret doing whatever was needed to make sure that its infants gotten educations

The new $step one.seven trillion scholar loans drama was dropping towards shoulders from forty-five billion Us americans, ultimately causing enormous economic burdens for almost all. To have step 3.six million parents who got out financing to fund its kids’ university, personal debt you will definitely threaten old age.

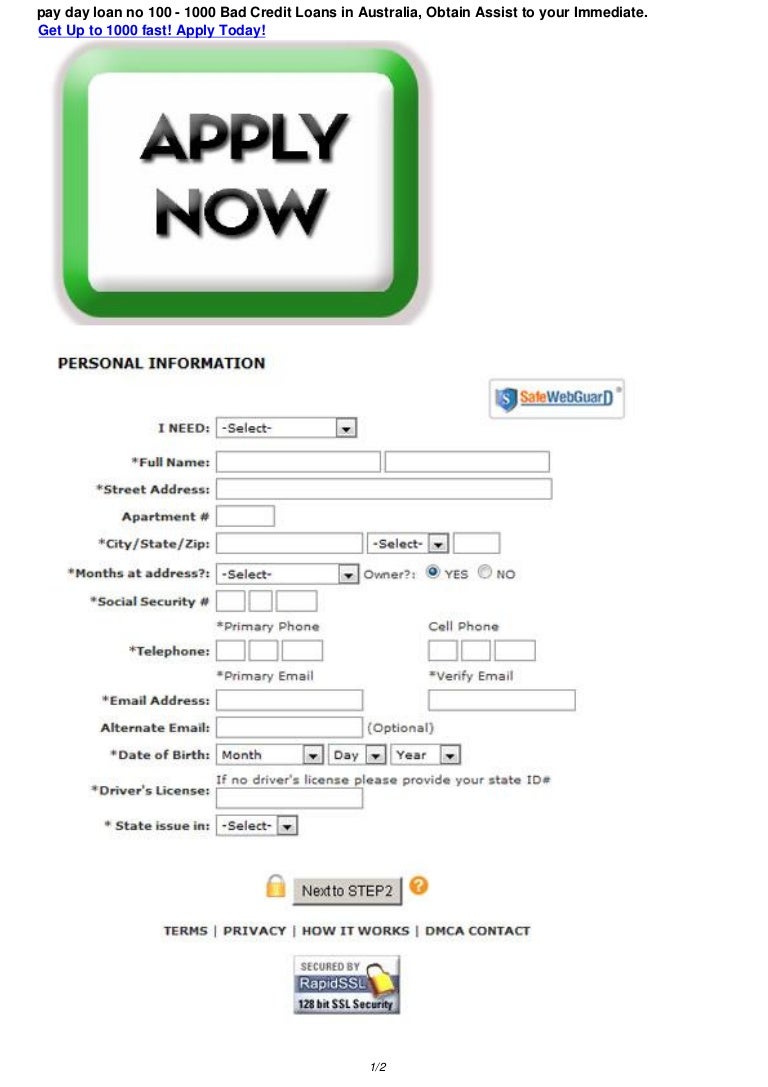

For an advantage financing, according to Federal Pupil proceed the link now Support (FSA), all mothers have to do is actually show he has a good credit score background and you will meet the general eligibility conditions getting federal student assistance, as well as the regulators will then provide her or him currency that defense as much as the expense of attendance because of their child minus any other financial aid the little one currently gotten.

An immediate As well as financing, commonly referred to as a father And additionally mortgage, is a type of federal education loan moms and dads can take out to cover their youngsters’ educations

Versus other types of college loans, even if, Together with money can gather quickly in the event the moms and dads does not have any the new economic means to pay them from quickly. Insider stated in the June into the the interest rates for different sorts of government figuratively speaking which will be in place up to July off next year: head finance getting undergraduates keeps a performance out-of 3.73%, lead financing to have graduates and you will experts provides a speeds of 5.28%, and you will Also money keep the large price from 6.28%.

The difficulty having Plus loans is they are way too simple to take out, for every single a report with the Tx Social Plan Base. That’s because the quantity mothers found is dependant on cost of attendance in place of simply how much mom and dad can actually afford. It will carry out a beneficial “hazardous attitude” leading in order to increased, and uncontrolled, borrowing, Andrew Gillen, author of the newest report, advised Google Money.

Insider in earlier times talked so you can a few parents that are driving off their advancing years as a consequence of rates on And money that will be and come up with challenging to settle your debt. Reid Clark, 57, abruptly became the only real supplier having their five students along with his personal debt weight now really stands at over $550,one hundred thousand.

“I’m considering purchasing $step three,100 thirty day period to your best an element of the remainder of living,” Clark advised Insider. The guy quotes he will need to keep and come up with those people costs to possess within the very least around three alot more age.

To have 64-year-old Robert Pemberton that has $265,100 within the In addition to money he took aside having his a couple of students, debt is an enthusiastic “unlimited course where in fact the mortgage can never be paid out of unless of course I’ve a windfall and you will shell out every thing, or We perish and it also disappears.”

Pemberton informed Insider the method to get the fresh new financing is surprisingly effortless, and then he discussed it becoming “on autopilot” as well as he had to complete was “signal a papers.”

In addition to loans were as part of the pandemic student-mortgage payment freeze, however when the fresh frost raises with the March step one, moms and dads or other federal college student-mortgage individuals will have to restart paying their personal debt.

“For these people who wish to pick our youngsters create best, we understand that you top yourself, while finest the possibility to achieve your goals, with knowledge,” Clark said. “And you can I’m simply not likely to make the chance for the not sending my personal kids to college, even in the event it will likewise manage a huge economic burden. It is far from an alternative.”