Everyone dream about all of our best household. Maybe your own provides a roomy backyard for your pets to help you wander. Or at least it is an apartment which have a nice look at this new sundown for every single night. While it’s easy to photo what you want your house so you can appear to be, brand new financial element may appear way more out of reach.

Once we commonly discuss toward all of our site, there are other suggests than ever to get to homeownership today, regardless of where you’re in your http://www.elitecashadvance.com/payday-loans-ar/houston/ finances.

On this page, we are going to familiarizes you with this new FHLB Grant program, the records, simple tips to be eligible for they, and just how it assists lower your principal, down payment, and you will settlement costs.

- What is the FHLB?

- What’s an enthusiastic FHLB Offer?

- How do you Qualify?

- Simply how much Normally A give Cut Me personally?

What is the FHLB?

The newest Government Mortgage Financial Work (FHLB) was passed and you may introduced for the 1932 from the Chairman Vacuum cleaner in the course of this new High Depression. New Act composed Federal Mortgage Banking institutions (FHLBanks), a system regarding 11 regional financial institutions you to try to be wholesalers to the lendable financing. Far more simply, meaning the fresh new FHLBanks give funds so you’re able to regional financial institutions to have these to provide to you personally in the form of a mortgage.

The structure of the FHLBanks is very important because ensures local banking companies gain access to financing to be competitive and provide good type of mortgage applications to customers.

What exactly is an FHLB Grant?

FHLB Has are around for qualifying homebuyers and will be studied to attenuate your dominating or wade towards your down-payment and you can settlement costs.

Such FHLB Provides try licensed through the Affordable Construction System (AHP), so you could find them also called AHP Has. The brand new AHP was developed into the 1990 and that is financed of the FHLBanks. For each bank contributes 10% of their income to the AHP, into intention of helping reasonable and you will reasonable-money domiciles reach homeownership.

How can you Be considered?

Earliest Tradition Home loan is actually happy to offer the Affordable Construction System to incorporate eligible lowest-to-moderateincome family and people which have an offer out of $eight,five hundred so you can $ten,000 toward their home pick.

Consult with your first Heritage Home loan manager to know when the your occupation match the latest certification regarding good COVID-19 relevant important worker.

To qualify for owner-filled features, and thus the house will probably be your top home, family earnings must be 80% or a reduced amount of your own county’s average money.

There are also grants available for leasing characteristics in which no less than 20% of your own units might be reasonable to possess and occupied because of the very low-income house, defined as income within fifty% or a reduced amount of this new average county earnings.

Likewise, there are designations eg people couples, which include vital society users which assist other people to have a living. The police, teachers, healthcare specialists, firefighters, or other very first responders, along with veterans and effective-obligation military fall into this community. For additional information on ideas on how to be eligible for this community, it’s best to consult that loan manager, since they are masters in these apps.

The latest applications we offer in the beginning Heritage Home loan render reduced-to-average money household and people between $7,five hundred and you will $ten,100000 with the their home pick.

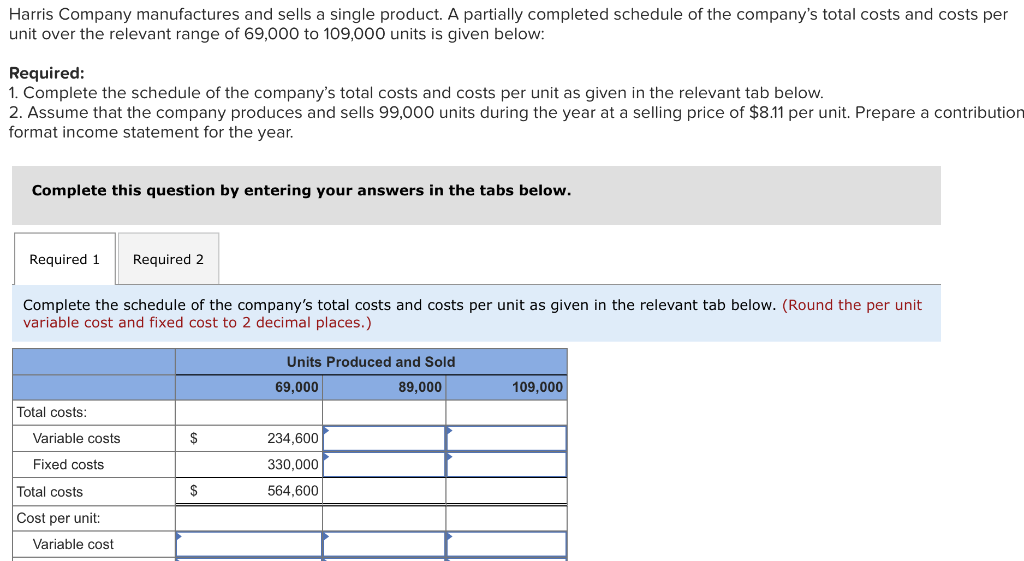

To give a bona fide-industry circumstances, glance at how a great homebuyer within the New york you’ll save yourself $21,777 on the closing costs from Vermont Household Virtue Financial System (NCHFA), a provider away from FHLB Has. Then they have to set-out just $2,096 in addition to their payment rises of the merely $80.

Whether or not you are taking advantage of a keen FHLB Give, or another system, you will need to know that of several software are around for assist you accomplish your ultimate goal, therefore don’t need to locate them your self.

Apply to an initial Culture Mortgage officer who will opinion your personal financial predicament and you may reputation one take advantage of the best loan system to you.

Question

- To invest in a property

- Deposit

- First-big date Homebuyer

- Financing Selection

The incorporated posts is supposed to have educational intentions merely and should not be relied upon as the professional advice. Additional conditions and terms apply. Only a few applicants commonly meet the requirements. Consult a money elite group for taxation guidance or a home loan top-notch to handle your home loan questions otherwise issues. This is an advertisement. Prepared step 3/9/2022.

The merchandise Or Provider Has not been Recognized Or Endorsed From the One Governmental Department, And that Bring Isnt Getting Made by A company Regarding The government. For more information and additional conditions of New york Home Advantage Home loan Program, please go to: nchfa.

Having NCHFA + FHLB financial support according to the family conversion rate shown on the chart more than that have a first and next financial. First mortgage are a thirty-year FHA fixed-price financing which have % CLTV, 3.625% interest rate, and you may cuatro.818% Annual percentage rate. 2nd home loan try an effective 15-season repaired-speed mortgage with 0% appeal. The brand new payment is sold with joint prominent and you can attention into first and you can second financial together with projected costs for taxes, homeowners insurance, and you will mortgage insurance coverage.

Without NCHFA + FHLB resource in accordance with the household transformation rate found in the chart significantly more than with a thirty-season FHA fixed-rate mortgage, $twelve,950 downpayment matter, step 3.625% interest, and you will cuatro.818% Annual percentage rate. The monthly payment boasts estimated costs to possess taxes, home insurance, and you may mortgage insurance coverage.

Standards for financing system degree and you can rates of interest towards loan programs are very different predicated on credit requirements, final amount away from down payment, and are usually at the mercy of market costs. . Cost work and you will susceptible to changes without notice. Brand new said range could possibly get alter or otherwise not be accessible during the duration of union or secure-when you look at the. This can be an advertisement and not a vow from lending. Conditions and terms pertain. Most of the approvals at the mercy of underwriting direction. Waiting .