Everyone requires help from every now and then, exactly what if it help is more than just a few hundred bucks, plus particularly good $1500 financing?

You need $1500 but not yes where to start? The good news is that we now have possibilities, even though you require money rapidly. When you get the loan need, you could potentially take steps instance performing a savings financing to prepare yourself having coming issues. Continue reading a variety of options to obtain the financing you would like.

Assume you haven’t taken out a loan in advance of otherwise you would like an excellent refresher. If that’s the case, there are many certificates (and additionally a working savings account) you to definitely loan providers have a tendency to inquire about:

1. Your revenue

For many individuals, their income was from a day job. However, option sourced elements of income like SSI, price functions, and area-big date performs are merely some examples to include whenever rewarding a living requirement. Lenders will have to be sure to have sufficient earnings to help make your financing payments.

dos. Capability to Create For every Payment per month

In addition to earnings, loan providers often inquire about major monthly expenditures like your rent/mortgage repayment and other debts. This may let them have a much better notion of exactly how much you are able.

3. The Creditworthiness

Finally, your credit score and you may credit history will determine the type of mortgage selection and you may loan providers online. Some lenders are accessible to financing in order to individuals with bad credit histories, and others may well not.

Here are certain loan choice you can attempt dependent on what your credit score turns out. Discover more about fico scores in addition to their scores to search for the group your belong.

Loan Solutions If you have a fair Credit score

The great thing about having reasonable borrowing is you usually convey more mortgage choices to pick from, and that not all people gets. Concurrently, a good credit score function you can acquire finest mortgage terminology (more about you to lower than).

Personal loans

Signature loans are among the most made use of loan solutions. Having fair in order to higher level credit, there is certainly many unsecured loan choices to thought. A lender, borrowing from the bank partnership, or a personal bank all are financial institutions offering private funds.

Unsecured loans can be used for all sorts of expensespared so you’re able to much harder financing, the loan software techniques might be reasonably quick. Shortly after recognized, the funds should be sent directly to your money.

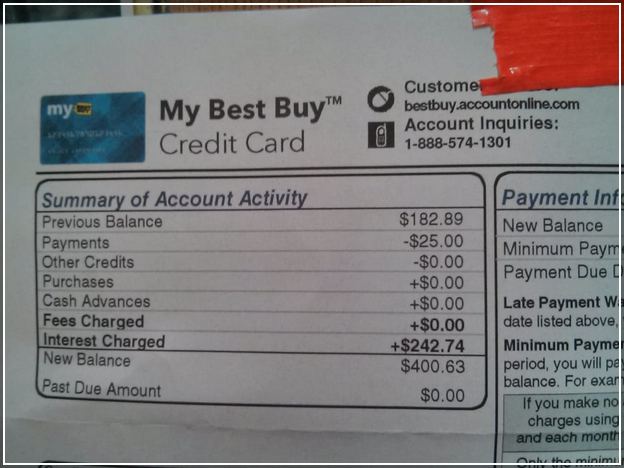

Playing cards

Playing cards should be an alternative choice so you can borrow money, when you have a good credit score. Otherwise currently have a charge card to be used, check out charge card has the benefit of that have basic no otherwise low interest pricing.

Cash advances

People choose withdraw money using their bank card. This is referred to as a credit card cash advance. The interest prices are now and again more than typical mastercard sales. Plus, there isn’t any elegance several months for the appeal, definition it does start to accrue quickly.

$1500 Fund when you have Bad a credit score

Even if you reduce than perfect credit score, there are mortgage options you can look with the. Listed here are some him or her:

Poor credit Signature loans

Particular lenders focus on personal loan options for poor credit borrowers. A consumer loan to own less than perfect credit background can be a guaranteed or unsecured loan solution (secured personal loans include guarantee, while unsecured do not).

Payday loan

An online payday loan was a short-title mortgage that’s meant to be paid off by the 2nd payday, which title. These loans appears like a very good way to discover the loans you need, especially if you you need easy online payday loans her or him rapidly. not, payday loan will be high priced, and to repay the borrowed funds you’re required to spend lots of focus.